How to File GSTR-3B on GST Portal

Step:1- Login in your GST portal with your GSTIN number

Step 2: After login Select financial year and return period period and click on search like below screenshot:

Step3: Click on "Prepare offline" like below screenshot:

Step 4: Upload file (JSON) file by clicking on "Choose file" option like below screenshot

Step 5: After uploading wait 15 minutes then Click on "Monthly return" like below screenshot:

Step 6: Click on "Ok" like below screenshot::

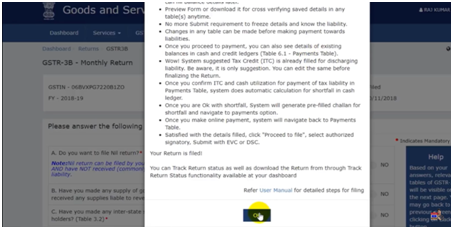

Step 7: Set to “Yes” the required option and click on "Next" like below screenshot::

Ø After that you can see your details about GSTR 3B in this report like below screenshot::

Important points for Scrap under GST

1. RCM

is not applicable on Scrap when Regular dealer purchase from consumer or

unregister dealer under GST.

2. RCM

is applicable when register person purchase scrap from government party or

local authority under GST.

3. If

government party or local authority sales scrap to Unregister party then he is liable

to pay GST to government.

Note: Manufacturing

and sale of all kinds of iron and steel like iron rods, bars, and scraps of

iron and steel etc are charged at the rate of 18% GST.

Note: TCS

(1%) from 01/04/2021 is applicable on sale of scrap to any party.

Note: TCS

is not applicable on sales for Personal use, Manufacturing, Productions,

Consumptions etc.

Note: TCS

applicable on only sales for trading purpose.

Note: TCS

is also applicable on sales exceeds 50 lacs from 01/10/2020 and seller must be

crosses his turnover 10 crore in previous financial year.

Note: In

this case TCS calculated on Total Invoice value (Scrap value+GST tax).

0 Comments